About this Gig

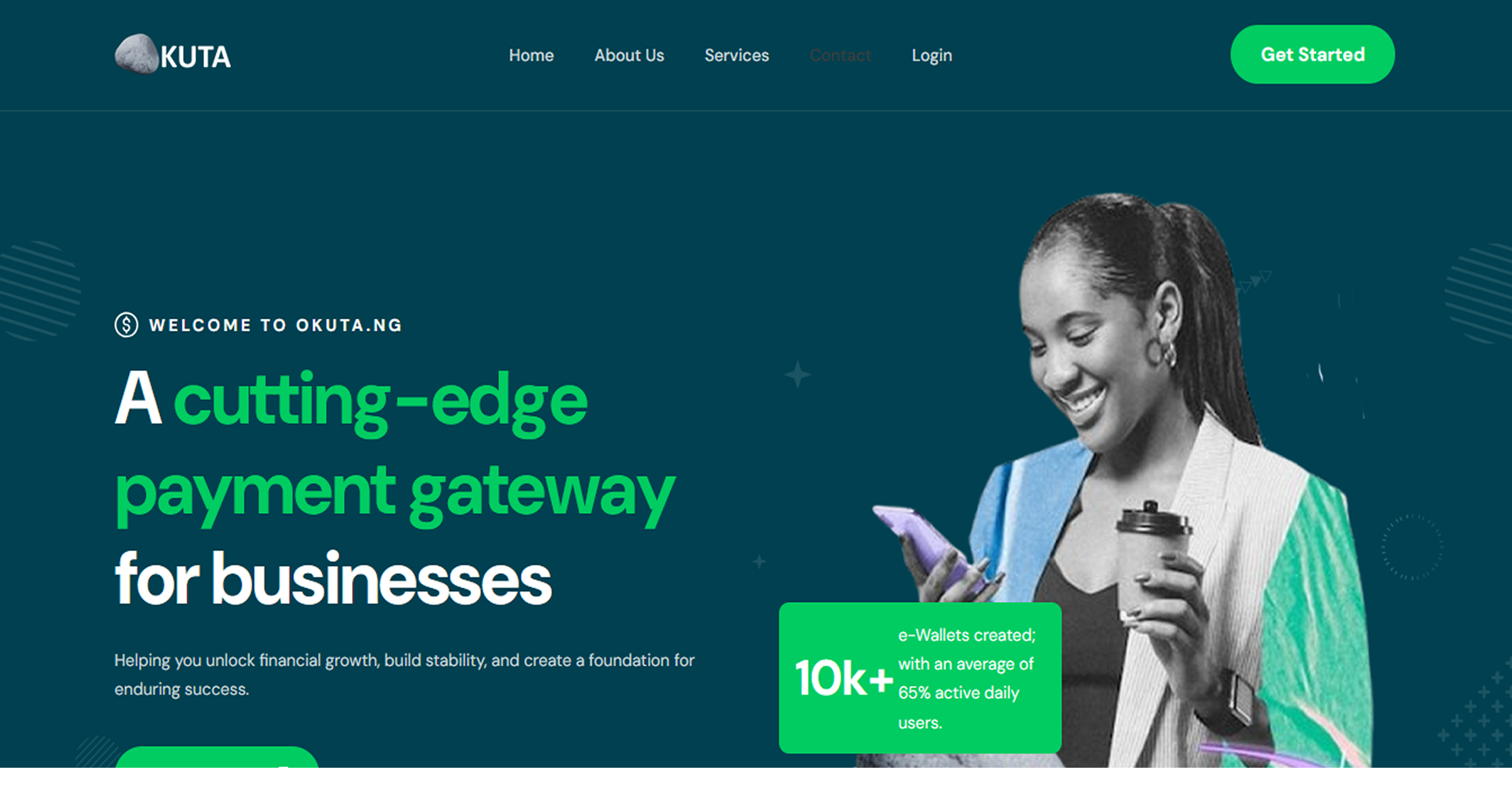

Transform your financial business with our cutting-edge Fintech solutions. As a team of seasoned financial technology experts, we specialize in creating secure, scalable, and innovative fintech applications that drive growth and enhance customer experience.

What You Will Receive:

1. Comprehensive financial application development (mobile & web) 2. Secure payment gateway integration 3. Blockchain and cryptocurrency solutions 4. AI-powered financial analytics and forecasting 5. Regulatory compliance (KYC, AML, GDPR) 6. Banking API integration and open banking solutions 7. Real-time transaction processing systems 8. Custom dashboard with financial insights

Why Choose Us:

a). Over 10+ years of exclusive fintech development experience b). Worked with multiple financial institutions globally c). Deep understanding of financial regulations d). Cutting-edge security protocols implementation e). Agile development methodology

Our process begins with a thorough analysis of your business needs, followed by strategic planning, iterative development, rigorous testing, and seamless deployment. We ensure your fintech solution not only meets but exceeds industry standards while providing an exceptional user experience.

Why Work With Me

We offer professional fintech development services to transform your financial business with cutting-edge technology solutions.

You will receive:

a). Complete source code of the application b). Detailed documentation c). Installation and setup guide d). 1-hour video call tutorial e). 30 days of technical support f). All design files and assets g). Testing reports and quality assurance certificates h). API documentation for all integrated services

FAQ

What industries do you specialize in?

We specialize exclusively in financial technology including digital banking, payment processing, cryptocurrency platforms, lending solutions, wealth management apps, and regulatory technology.

How do you ensure security compliance?

We implement industry-standard security protocols including PCI DSS compliance, SSL encryption, two-factor authentication, regular security audits, and penetration testing. We stay updated with all financial regulations including KYC, AML, and GDPR requirements.

What is your development process?

Our process includes: 1) Requirement analysis & planning, 2) UI/UX design prototyping, 3) Agile development with weekly updates, 4) Quality assurance & security testing, 5) Deployment and post-launch support.

Do you provide ongoing maintenance?

Yes, we offer various maintenance packages including monthly updates, security patches, performance optimization, and 24/7 monitoring services to ensure your fintech application runs smoothly.

Can you integrate with existing banking systems?

Absolutely. We have extensive experience integrating with various banking APIs, payment gateways, core banking systems, and financial data providers including Plaid, Stripe, PayPal, and custom banking APIs.

Nigeria

Nigeria